Don Shurley and Nathan Smith

Department of Agricultural and Applied Economics

University of Georgia

The 2008 farm bill originally expired in 2012 but Congress failed to complete action to legislate new law to begin in 2013. The 2008 farm bill was instead extended for an additional year (through September 2013). Congress now still faces the task of developing a new farm bill that would begin with the 2014 crop year.

The full Senate approved its version of the farm bill (S. 954) on June 10, 2013. The House version (H. 1947) was defeated (failed to pass) on June 20. On July 11, the House passed an amended bill (H. 2642) which excluded the Nutrition title. These two bills (S. 954 and H. 2642) must now go to Conference Committee where the differences must be compromised to come up with a final farm bill that must then go back to both House and Senate for approval and then signed by the President to become law.

Concerns now are whether a Conference bill can pass the Senate without a Nutrition title and/or if the President would support and sign such a bill.

The following is a brief summary and comparison of the major Commodity Title provisions and commodity-related Crop Insurance Title provisions of both the House bill and Senate bill:

Both House and Senate bills eliminate

Direct Payments1 (DP) for all commodities. The exception is for cotton. The House bill would continue transitional Direct Payments for cotton for 2014 (on 70% of Base Acres) and 2015 (on 60% of Base Acres).

Both House and Senate bills also eliminate Counter-cyclical Payments (CCP) but establish a new, similar countercyclical-like payment for all commodities except cotton. The Senate bill establishes

Adverse Market Payments2 (AMP) for 2014-2018 crops. The House bill establishes Price Loss Coverage3 (PLC) for 2014 and succeeding crop years.

AMP would be received on 85% of Base Acres. PLC would be received on 85% of planted acres (not to exceed farm Base Acres) plus 30% of prevented planting acres. For AMP, peanut Base Acres and the payment yield may be updated to the 2009-2012 average. For PLC, payment yield for all eligible crops may be updated to 90% of the 2008-2012 average.

The ACRE program is eliminated in both bills.

The Senate bill establishes

Agriculture Risk Coverage4 (ARC). This is a revenue-based payment for all crops eligible for AMP. ARC payment is made in addition to AMP. Payment is based on benchmark farm revenue or county revenue. The producer must make a one-time irrevocable election.

The House bill establishes

Revenue Loss Coverage5 (RLC) as an alternative to Price Loss Coverage (PLC). Producer must make a one-time irrevocable election of PLC or RLC. The election may be on a 2 farm by farm and crop by crop basis. RLC payment is based on benchmark county revenue. There is no farm option.

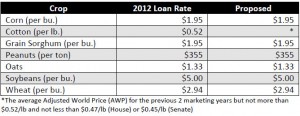

Both House and Senate bills continue the current Marketing Loan program including Loan Deficiency Payments (LDP’s).

Loan Rates6 remain as in the current law except for cotton. In the Senate bill, the loan rate for cotton will be the average AWP (Adjusted World Price) for the previous 2 crop years with a minimum of 45 cents and maximum of 52 cents. The House bill is the same as the Senate bill except the minimum is set at 47 cents.

Cotton is not included in AMP, ARC, or PLC/RLC. Instead, both House and Senate bills would establish a new revenue-based insurance program called

STAX7 (Stacked Income Protection Plan) for cotton beginning with the 2014 crop. The STAX policy may be purchased as a stand-alone policy or in addition to other coverage. The STAX premium subsidy is set at 80%. A payment (indemnity) is received when actual county revenue falls below 90% of benchmark county revenue.

Both House and Senate bills create a Supplemental Coverage Option (SCO) under the Crop Insurance Title that would allow the purchase of additional coverage on an area basis. In the Senate bill, indemnities would trigger for area losses greater than 22% for producers enrolled in ARC or greater than 10% if not in ARC. The House bill is similar except indemnities trigger if area loss is greater than 10% and SCO is not available if enrolled in RLC or STAX.

The Senate bill amends the Federal Crop Insurance Act to make available revenue crop insurance coverage for peanuts beginning with the 2014 crop. The House bill makes a revenue protection policy for peanut producers a priority so that it is available for the 2014 crop year.

The Senate bill retains separate but equal payment limits for peanuts. The House bill includes peanuts into the limit with all other program crops. The House bill sets the total payment limitation at $125,000 with the spouse rule allowing doubling of the limit. The payment limit on marketing loan gains/loan deficiency payments would be $75,000 and other payments (PLC/RLC and transitional cotton Direct Payments) set at $50,000. The Senate bill calls for a $50,000 limit on combined ARC and ARM payments and a $75,000 limit on loan gains/LDP’s.

Adjusted Gross Income (AGI) eligibility requirement is established as a 3-year average of total AGI greater than $950,000 in the House bill and $750,000 in the Senate bill.

In both the House and Senate bills, for the purpose of determining payment eligibility, the definition of “actively engaged” in farming is changed to include a contribution of active personal labor.

The House bill makes the 2013 farm bill permanent legislation by repealing the permanent legislation of the Agricultural Adjustment Act of 1938 and Agricultural Act of 1949. Under the current bill, provisions from the Acts would kick-in at the end of this year if a new farm bill is not passed by Jan 1 or the 2008 bill is not extended again.

The Senate bill repeals the 1938 and 1949 Acts for the 2014 to 2018 crops, i.e. the duration of the new farm bill—which is how previous farm bills have worked.

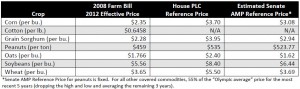

1/ Direct Payments are completely “decoupled”—a fixed payment not dependent on market price or farm actual acreage and yield. The Direct Payment Rates for 2012 were:

Direct Payment = DP Rate x DP Yield/Acre x 85% of Base Acres

2/AMP Rate = AMP Reference Price – Higher of 12-month Average Market Price or the Loan Rate

AMP Payment = AMP Rate x 85% of Base Acres x Payment Yield

3/ PLC Rate = PLC Reference Price – Higher of Mid-Season Market Price or the Loan Rate

PLC Payment = PLC Rate x (85% of Planted Acres + 30% of Prevented Acres) x Payment Yield

4/ Farm Option

ARC Payment = ARC Rate x (65% of eligible* planted acres + 45% of prevented acres)

County Option

ARC Payment = ARC Rate x (80% of eligible* planted acres + 45% of prevented acres)

*Total eligible acres cannot exceed the average total acres planted for 2009-2012.

ARC Rate = ARC Guarantee – Actual Crop Revenue or maximum of 10% of Benchmark Revenue

ARC Guarantee = 88% x Benchmark Revenue

Benchmark Revenue = 5 year average yield** x 5 year national average price**

Actual Crop Revenue = Actual Crop Yield x higher of the national average price or the Loan Rate

**Excludes the high and low years, averaging the remaining 3 years

5/ RLC Payment = RLC Rate x (85% of planted acres + 30% of prevented acres)

RLC Rate = County Revenue Trigger – Actual County Revenue

County Revenue Trigger = 85% x Benchmark County Revenue

Actual County Revenue = Actual County Yield x higher of Mid-Season Price or Loan Rate

Benchmark County Revenue = 5 year average county yield* x higher of Mid-Season Price or Reference Price or the Loan Rate

*Excludes the high and low years, averaging the remaining 3 years

6/ Loan Rates are used to calculate Loan Deficiency Payments (LDP) when available and may also be used in calculation of AMP, PLC, ARC, and RLC.

7/ STAX is an area-based (county) revenue policy that covers “shallow losses” independent of and in addition to any other policy the producer may have. An indemnity is made for county losses greater than 10% but not more than 30% or the loss level (deductible) of the other/individual policy, whichever is less.*

STAX Indemnity = (90% x County Reference Income – Actual County Income) or

20% x County Reference Income, whichever is less*

Protection Factor—The producer has the option of selecting a Protection Factor of not more than 1.20 to increase the STAX Indemnity. For example, if the Indemnity were $20 per acre and the producer had selected a Protection Factor of 1.2, Indemnity received would be $24 per acre ($20 x 1.2)

County Reference Income = (Higher of County Average Yield** or Trend Yield) x (Higher of Projected Price*** or Harvest Price***)

Actual County Income = Actual County Yield x Harvest Price

*STAX and a producer’s stand-alone policy cannot overlap. If the individual, stand-alone policy has greater than 70% guarantee (less than a 30% deductible), the maximum STAX Indemnity will be (Deductible – 10%) x County Reference Income.

**For the previous 5 years excluding the high and low yields and averaging the remaining 3 years

***The Projected Price and Harvest Price will be the same prices used for a stand-alone individual Revenue Policy (formerly CRC). STAX can be purchased without the Harvest Price option for Reference Income.