by Levi Russell

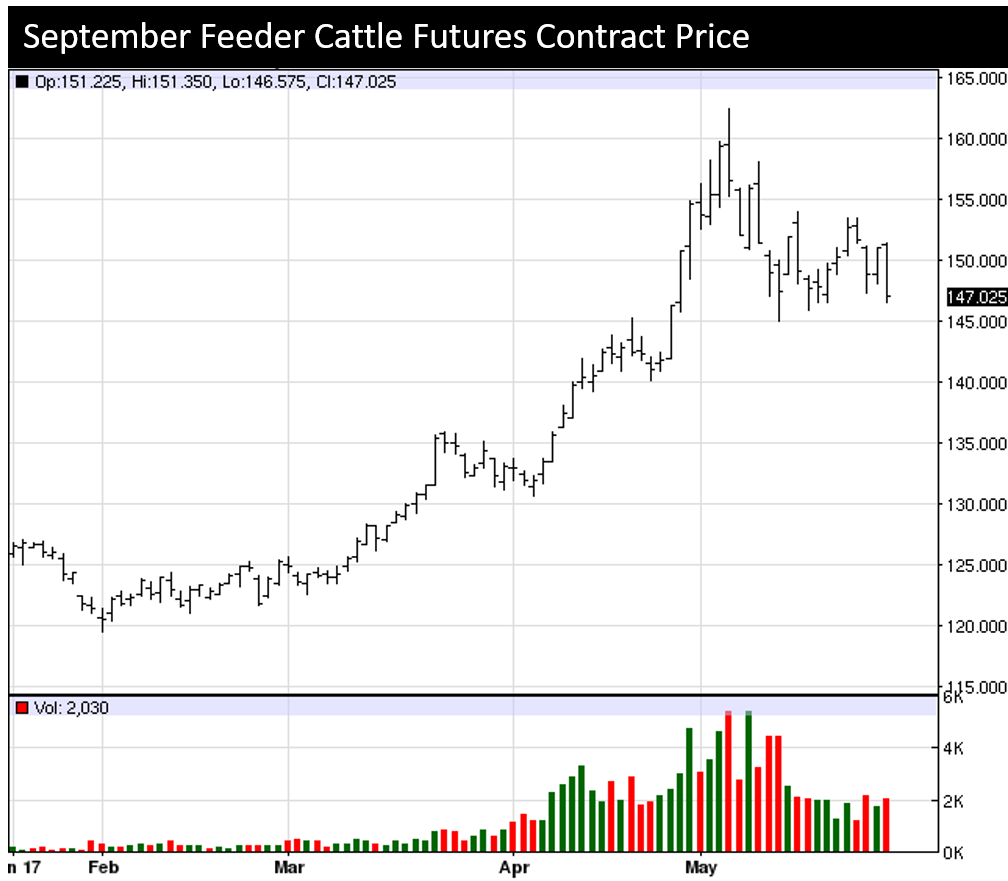

The recent run-up in wholesale beef prices has sent cash and futures prices through the roof in the past few weeks. This provides an opportunity for producers with spring-calving herds to lock in a profit. For instance, right now producers can buy a put option on the September feeder contract at a strike price of $135/CWT for $1,375. This is relatively cheap “insurance” since we’re likely to see calf prices fall again in the near future as wholesale beef drops back down or feedlot margins are squeezed.

Today’s cattle on feed report is a good example of bad news at the feedlot level affecting marketing prospects. So far today we’ve seen a significant drop in feeder futures due to the slow pace of marketing relative to placements in April. Now is a good time to lock in profit as we’ll probably continue to see some downward pressure on feeder prices in coming months.

For more information on hedging and options, check out the following publications.

Understanding and Using Cattle Basis in Managing Price Risk

Using Futures Markets to Manage Price Risk in Feeder Cattle Operations

Commodity Options as Price Insurance for Cattlemen