Every once in a while, I will get a comment or question about how to charge for hay. Growers need to know their cost of production to calculate the profitability of their operation. A production budget is a way to organize revenue, expenses and then calculate profit for the commodity that is being produced. If a grower needs hay market information then a great resource is the USDA Agricultural Marketing Service. Hay prices can be very locally driven based on supply and demand, and forage quality.

When growers are penciling out a budget, the production expenses are classed as fixed or variable costs. In the variable cost portion of the budget, the inputs associated with the production of the crop are included. Feed, fertilizer, seed, crop protection, and fuel are considered variable costs. A producer has control over these expenses in the short run, and they will change as total production changes. Currently, inputs such as fertilizer and fuel have increased, resulting in a lower probability of a profit. According to Amanda Smith, UGA Ag Economist, various inputs have increased compared to a year ago. For example, nitrogen, phosphorus, and potassium have increased 45%, 53%, and 18%, respectively. Farm diesel is averaging around $2.50 per gallon at the moment; last year at this time, it was under $2 per gallon.

One resource that county agents and growers have access to is UGA production budgets and which can be at https://agecon.uga.edu/extension/budgets.html. Remember that the most important column in production budgets is the one named “Your Farm.” Producers utilize different production practices and are in various financial situations.

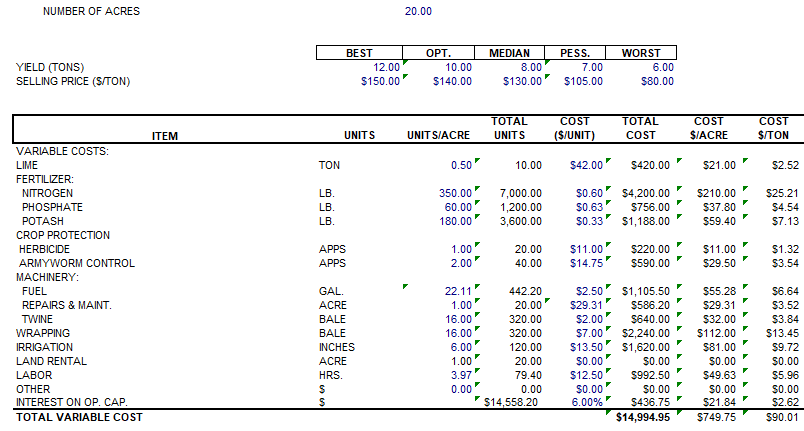

The illustration below shows the variable costs for irrigated large round ball bermudagrass production. In this example, the prices of N = $0.60, P = 0.63, and K = 0.33 per unit are used. The current fuel prices are around $2.50 per gallon. The fertilizer recommendations are based on UGA Soil Sample recommendations. This example is based on 20 acres of production with an 8-ton yield. Land rent is not included in this budget. The variable cost for this example is $90.00 per ton or $749 per acre.

Fixed costs, on the other hand, include the costs of owning a fixed input or resource. These fixed costs incur even if the input is not used. Fixed costs include depreciation, insurance repairs, property taxes, and interest. For perennial forages, such as bermudagrass the establishment costs can be spread over numerous years and are included in the fixed costs.

One common challenge for hay production is the equipment requirements. Hay producers need balers, rakes, tedders and other equipment which can be very expensive. Your county agent can assist producers with calculating equipment costs. Factors such as equipment age, capacity, interest rates, repair costs and other things can influence the fixed costs of the operation. Custom harvest might be an option for producers who cannot afford equipment.

If you have any questions about hay economics please contact your local county Extension agent.